Taxation of betting: the right path or a gateway to illegal gambling?

Written by :

Heloisa Vasconcelos

Reviewed By :

Larissa Borges

After months of speculation and expectations that lasted more than 4 years, the sports betting provisional measure was signed by President Lula last Tuesday, the 25th.

The main point of discussion of the approved text is related to the rates that will be applied to both brands and bettors.

Betting houses will have to pay 18% on Gross Gaming Revenue (GGR, revenue collected from all games, after paying prizes to bettors and deducting income tax from the prize amount). Bettors will have to pay 30% on prizes above R$2,112.00 .

This taxation divides opinions: while the charges are necessary for the activity to be regulated, aren’t they “too high” to keep the market attractive?

This is what we discuss in this article, which brings together opinions from legal and accounting experts and the views of representatives from the National Association of Games and Lotteries (ANJL), the Brazilian Institute of Responsible Gaming ( IBJR ) and the Brazilian Institute of Legal Gaming ( IJL ).

Sports betting has been categorized as lottery games

According to sports betting specialist lawyer Udo Seckelmann, from Bichara e Motta Advogados, the taxation applied to bettors was a crucial error in Brazilian regulation.

In Law 13,756/2018, fixed-odds sports betting was classified as lottery activities. Therefore, they are subject to the same taxation.

Taxation is 30% tax on prizes over R$2,112

“The fact is that sports betting is completely different from conventional lotteries, so it deserves different taxation,” notes the expert.

André Gelfi, CEO of the Brazilian Institute of Responsible Gambling (IBJR), believes that by applying the same concept, gamblers are harmed. “We are talking about a product that is completely different from the lottery, with different mechanics: in the lottery, few prizes of very high values are paid out, and in sports betting, many prizes of very low values are paid out,” he points out.

For Eliane Soares, an accountant with over 28 years of experience and a specialist in taxation and accounting at Aposta Legal Brasil, the numbers seem frightening, but there is a context behind them that must be considered: the strengthening of public coffers.

“This higher tax, of 30%, occurs because this is a ‘gambling’ activity, with the potential to generate addiction, following the same line as the taxation on cigarettes and alcoholic beverages, for example. It is not a tax that is levied on essential products or services in the life of citizens, such as basic food items, electricity and water services, among others”, he points out.

High taxation could stimulate the illegal market

Experts agree that the tax on bettors, which will be withheld directly by bookmakers, could stimulate the illegal market in some way.

In Seckelmann’s opinion, the search for illegal betting houses could become more popular for bettors who move large amounts of money — and who would be taxed.

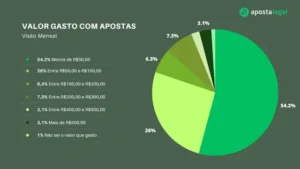

A survey carried out in partnership between Aposta Legal Brasil and Opinion Box, which mapped the behavior of Brazilian bettors , shows that more than half spend less than R$50 per month on betting.

This amount is far from the exemption ceiling, but it is worth noting that the tax will be applied to the winnings . In any case, turning R$50 into more than R$2,000 with bets is not an easy task.

The point is that there is a group of bettors who, even though they are small, spend large amounts per month.

“Perhaps most recreational bettors will look to bet on the licensed market, but “VIP” bettors, who tend to bet large amounts, will tend to look to the unlicensed market,” says Seckelmann.

Still in the lawyer’s view, taxation, as it stands, “ignores bettors’ losses and taxes each of the prizes, which will have terrible consequences for VIP bettors, many of whom are preparing to bet on the unlicensed market if this is not changed”.

![]()

“ When choosing an operator, a bettor will have to balance the advantages and disadvantages of each: if he values legal certainty over good odds, he will opt for the licensed market; if he values better odds over legal certainty, he may opt for the unlicensed market. ”

The CEO of IBJR believes that it is unlikely that bookmakers will continue to offer their current services to gamblers. This could harm the revenue forecast by the Federal Government.

“The high operating costs of betting houses will not make it possible to maintain the same odds that players are already accustomed to, redirecting these bettors to illegal sites, both in Brazil and internationally,” points out Gelfi.

Wesley Cardia, president of ANJL, reflects on the effects of tax collection: “We understand that the government needs to increase tax collection to, among other things, invest in public policies, but I think it is difficult for people to make the connection that the discount is to fund social projects, when they see that almost 1/3 of their premium is going away in taxes”.

“Our biggest fear with this excessive taxation is the migration of the most significant bets to illegal sites,” he concludes.

Even with taxation considered high, Eliane Soares highlights the implications of betting on the illegal market:

“The regulations are “very tough”, with penalties even for internet providers that host illegal sites, which will help to deter offenders. It is a power that was given, among others, to the Ministry of Finance, to ‘take down’ these illegal sites”, he says.

Focus is on tax collection, but impacts on the betting market are worrying

Experts interviewed by the Aposta Legal Brasil team point out that the taxation was excessive — especially when considering the other amounts that companies will have to pay. Magnho José, president of the Instituto Jogo Legal, believes that the total tax amount should reach 32% for operators.

In ANJL’s view, it is equally important to consider the tax burden that will come in addition to the 18% on the GGR: “The tax burden is very high, especially because, in the end, it will become around 35%, when including other taxes such as Cofins, CSLL, IRPJ, PIS, ISS, etc.”

The possibility of high rollers resorting to illegal alternatives is worrying, mainly because companies may also be interested in operating in the unregulated market.

“No serious, legal company can sustain its business by having to pay almost a third of its revenue in taxes to the State. The one who loses out with a high tax burden is the government itself, since the fewer licensed companies there are in the country, the lower the tax collection will be,” Cardia highlights.

The CEO of IBJR agrees: “A monitoring fee will also be added to the established value. In other words, it is unsustainable to maintain the interest of new companies and the long-term investment of betting companies that are already present in Brazil.”

Even amidst debates, regulation came at a good time

The Betting Law , approved in 2018, was an initial step towards regulating the market, which happened 4 years later. Even with discussions and the possibility of improving the text, experts agree that the MP came at a good time and will be important to strengthen the Brazilian market.

“The MP was a necessary measure, since the lack of regulation left the market without rules, insecure and prone to irregularities, which ended up giving room for the actions of companies that are not committed to responsible and honest gaming”, points out the president of ANJL.

Solutions could come from inspiration from other countries

Countries seen as a “positive example” by experts who advocate tax adjustments are Portugal and Canada. In both locations, only operators are taxed — bettors do not have to pay any type of tax on their winnings.

Udo Seckelmann believes that one solution for Brazil would be to adopt the same stance as Spain, which currently taxes gamblers’ winnings but deducts their losses.

![]()

“ Since the beginning of the regulatory process, the Ministry of Finance defended that the taxation model would be that of the United Kingdom, which is 15% of GGR (Gross Gaming Revenue), but, at the end of the debates, taxation was increased from 15% to 18% of GGR. ”

Speaking about taxation of operators, the United Kingdom is an example, according to the president of the IJL.

The president of the IJL believes that “taxation outside the reality of the best global practices could be disappointing for the government’s estimates, which works with a channeling of 87% of current bettors”.

“In addition to high taxation, executives interested in applying for a federal license evaluate other risks such as competition with unregulated Brazilian operations, illegal gambling, offshore operators and state operations,” he points out.

![]()

“ Even because we still have to think that new rates could be created for real, presumed or even Simples Nacional profits for these activities. ”

Eliane SoaresAccounting Businesswoman

Something unanimous among experts was the possibility — and even necessity — of reviewing the taxation approved in the current version of the MP.

Accountant Eliane Soares believes that, after the regulations are in force, it is quite possible that corporate taxation could be reviewed.

![]()

“ The MP is another important step in the regulation of sports betting in the country, which should be implemented after the publication of a series of ordinances by the Ministry of Finance and the debate of the MP in the National Congress. ”

Mariana ChamelleteAttorney

Magnho José concludes with his perspective on a solution for taxation: “The text has 120 days to be reviewed by the National Congress and, during this time, the practices of countries that are successful with sports betting and stand out for taxation considered ‘fair’ for both public coffers and for companies and bettors must be observed”.

ANJL agrees: “We will take the market’s vision to the National Congress, to reach a more appropriate level, which is good for all sides: for bettors, for the government, society and companies that care about Brazil.”

The vice-president of the Brazilian Institute of Sports Law (IBDD) and specialist lawyer at Aposta Legal Brasil, Mariana Chamelette, believes that despite the MP having been initially approved with high taxation, “there is no model in the world that was born perfect”.

Just over a week after the approval of the provisional measure, deputies and senators have already added more than 40 amendments to the text. They mainly concern the destination of the amounts collected in taxes.